Q/A

Clear questions, straight answers

Discover everything you need to know about Advisory on demand – from membership and matching to booking and payments.

Questions from Advisors

Q: Am I an employee of Advisory on demand?

A: No, you act as an independent contractor (e.g., a consultant or sole trader). You are not an employee of Advisory on demand and are solely responsible for your own taxes, insurance, professional indemnity insurance, and compliance with all relevant laws in your field.

Q: A client I met through Advisory on demand wants to engage me directly for a larger project. Am I allowed to do this?

A: No, you are bound by a non-circumvention clause when matched with a client through Advisory on demand. If a client wishes to engage you for a long-term assignment, you and the client must notify Advisory on demand. This triggers a 'Success Fee', which the client pays to Advisory on demand, as outlined in our Terms of Service and Conditions, section 4.

Q: How and when do I get paid?

A: The client pays Advisory on demand in advance. After the session is completed, Advisory on demand will pay out your remuneration, minus the platform's service charge.

All pricing is inclusive of VAT. Advisory on demand is the merchant of record and handles VAT and payments. Advisors receive a percentage of net session revenue via Stripe Connect.

Q: How must I handle client information?

A: All client information is strictly confidential. You must not disclose it to any third party and may only use it for the purpose of fulfilling your engagement. This duty of confidentiality remains in effect for five (5) years after the engagement ends, and a breach may result in liquidated damages.

Q: What happens if a conflict of interest arises?

A: You are obliged to disclose any potential or actual conflict of interest immediately. You must not accept any assignment where such a conflict could compromise your professional integrity.

Q: Why does Advisory on demand charge a success fee on investments?

A: Advisory on demand provides curated access to senior advisors and leaders. Sometimes these introductions also lead to investments. In such cases, Advisory on demand applies a small success fee (1%) – just as is standard in executive search and corporate finance – because it is Advisory on demand’s curation that enabled the opportunity.

Q: Who pays the success fee if an Advisor invests in a Client’s company?

A: The Client is responsible for paying the success fee. Advisory on demand’s success fee is always charged to the Client. Advisors only pay the standard platform fee on advisory assignments. Advisors remain free to decide on their level of engagement.

Transparent value. Real fairness.

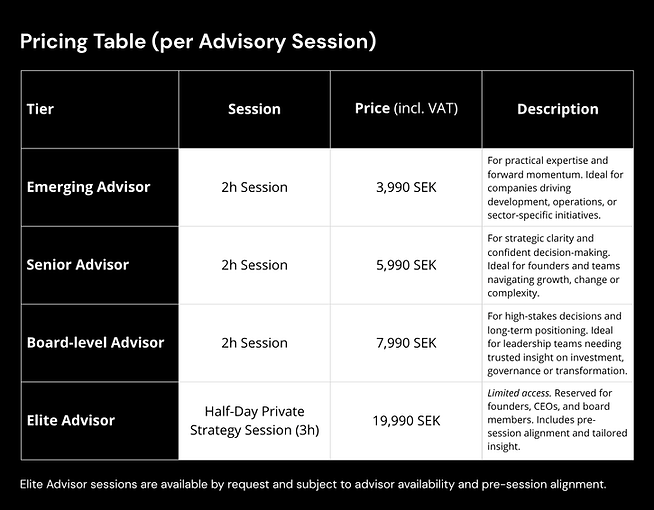

While other platforms charge double the hourly rate and list prices excluding VAT, Advisory on demand applies a transparent, inclusive model.

Our pricing ensures both clients and advisors benefit fairly – advisors receive a higher share per session, and clients pay less overall.

Every SEK is accounted for: from advisor compensation and platform fees to payment handling and taxes. That’s what we call transparent value creation.

Advisory Remuneration

Questions from clients

Q: Who actually provides the advice – is it you or the advisor?

A: Advisory on demand is solely an intermediary that matches you with the right advisor. The advice is delivered by an independent, third-party advisor who is fully responsible for its content and quality. Advisory on demand is not a party to the advisory service itself.

Q: What are the fees for using the service?

A: You pay a monthly subscription fee for access to the network and matchmaking service. Additionally, you pay a separate fee for each advisory session you book.

Q: Can I engage an advisor for a long-term project outside of the platform?

A: No, you are not permitted to do so during twenty-four (24) months from the date of the initial introduction. All engagements with an advisor introduced via Advisory on demand must be managed through the platform and/or service during this time. If the introduction leads to a long-term engagement (e.g., a board appointment, project contract), you are liable to pay a 'Success Fee' to Advisory on demand. Circumventing this is a material breach of contract and may result in liquidated damages.

Q: What is your cancellation policy?

A: You can reschedule free of charge up to 24 hours before the session is due to start. If you reschedule with less than 24 hours' notice or fail to attend, the fee is non-refundable.

Q: Who owns the intellectual property created by the advisor for me?

A: The advisor retains the intellectual property rights to the materials. As the client, you are granted to use them for your own internal business purposes. Resale or public distribution is strictly prohibited.

Q: What happens if an Advisor introduced by Advisory on demand invests in our company?

A: In such cases, Advisory on demand applies a small success fee (1%) on the investment amount. This fee is always paid by the Client, never by the Advisor. It ensures transparency and reflects the value of Advisory on demand’s curated introductions.

Q: What if an Advisor helps introduce our company to other investors?

A: Only introductions made through the core matchmaking service fall under the investment Success Fee. If an Advisor introduces a Client to a third-party investor entirely outside Advisory on demand’s scope, no fee applies.

Subscription

Price per session

The Advisory Model

Disclaimer on financial advice and regulatory status

Advisory on demand is not a financial advisor, securities broker, or investment firm under Swedish law and EU regulations (MiFID II). We do not provide investment advice, manage client assets, or act as an intermediary for securities transactions.

Our role is strictly limited to curating and facilitating introductions between independent advisors and business clients. Any investment decisions are made directly and independently between the parties involved. Advisory on demand does not handle capital transfers, provide recommendations on specific financial instruments, or act as a party to investment agreements.

All users acknowledge that Advisory on demand operates as a matchmaking platform only, and that neither Clients nor Advisors should construe our services as financial advice or securities intermediation, which requires authorisation from the Swedish Financial Supervisory Authority (Finansinspektionen, FI).